The advent of technological advancement has commenced a headway revolution of innovative techniques. The emergence of automation and mechanization has provided convenient yet efficient solutions to problems comprehended as impossible to solve. However, in contrast to these inventions, people faced a fair share of obstacles such as frequent fraudulent and hacking activities. Therefore, over the past decade, the techno-advancement industry has readily made efforts to transfer the manual system to an automated online system. This shift aims to maintain the safety and storage of the database alongside alleviating the lengthy procedures into easy to use and efficient approach.

The swift-moving pace of manual to online systems has prompted some of the biggest yet well-known organizations, financiers, industries, and commercial hubs to adapt and promote the online systems quickly. But, on the contrary, scammers, fraudsters and hackers exploited this opportunity and deceived many investors into monetary traps. Moreover, the non-transparency in the online systems shook people’s confidence and evoked them to consider other options that are not even high-yielding. Suppose similar experiences and thoughts have seized you. In that case, this article will explain to you the meaning and purpose of an LEI number and how it can validate your investments, transactions, and dealings with its many offerings.

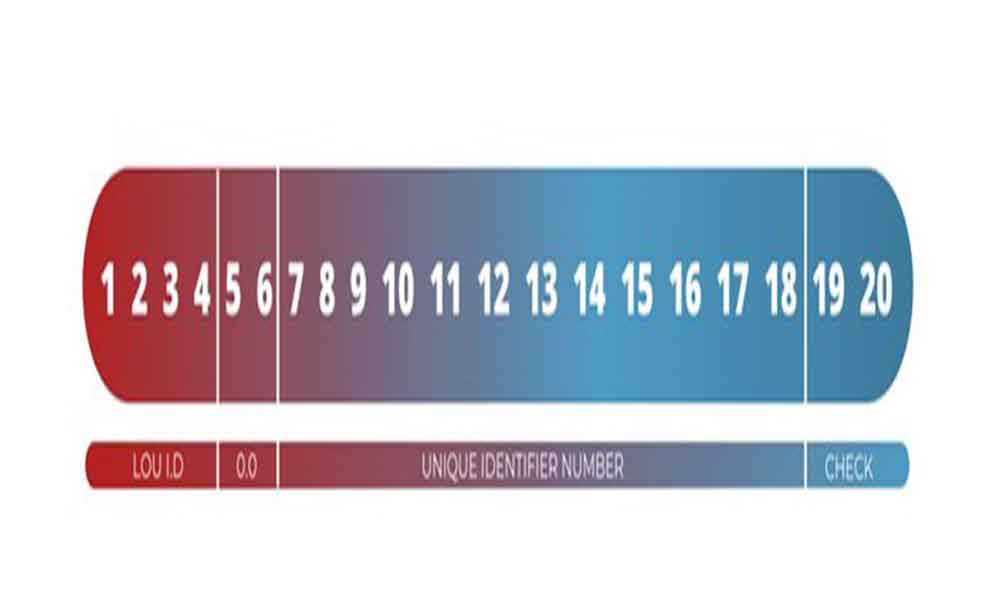

The main elements for investing in financial markets include transparency, standardization, and risk control. LEI stands for (legal entity identifier). Hinting from its name. LEI number is a code issued to entities on a global scale, assuring their legal identity. Amid the chaotic economic activities, a lot of entities display themselves as legally approved. This has caused significant malfunctioning in financial trading, incurring huge losses to investors and entities. In addition, duplication, replication, frauds, delusions, and scams have been common yet significant issues. Similar to these disruptive issues, the LEI number came into existence after the mass market crash of 2008. In the latter days of 2008, lack of transparency in transactions disrupted a turmoil as counterparties couldn’t be identified. When the stock market crashed, many funds and trusts couldn’t be placed as they had no legal entity identification. This led to mass confusion of anonymous parties resulting in a lack of transparency in the financial affairs. Financial institutions and banks were in a state of complete astonishment as they had no clue about the underlying situation. The concept of LEI number emerged following the incident. Even though it was under consideration for some time, this big breakthrough prompted the financial institutions to develop a permanent yet proactive solution. To understand the concept and application of LEI, continue scrolling through the article to clear relevant ambiguities.

Table of Contents

To which entities are LEI applicable?

Entities that include entitlement of carrying out legal and financial activities, including the practice of transactional activities and legal rights in their jurisdiction to enter in legal contracts independently, have to issue a LEi code for global identification and regulation. The nature of these entities in case of being incorporated or constituted, such as if it’s a trust, partnership, or a contractual-based entity, is equally applicable for LEI. This categorical classification includes governmental bodies, supranational and sole proprietors working in a business capacity. It excludes natural persons concerning its requirement and relevant clauses.

Is the issuance of the LEI code mandatory?

LEI code is mandatory for entities that qualify the criterion of being involved in financial activities. Banking systems, financial intermediaries, Trade (OTC),SMSF, CFDs, SFTR, etc., are some of the top financial market institutions which should contain an LEI code for their global identification and validation.

Do authorities monitor LEI code issuance?

Varying authorities monitor LEI code on the subject of its mandate requirement for entities validation and authentication. Authoritative bodies such as MIFR, EMIR,MIFID,SFTR,CSDR, and MIFIR scrutinize and monitor the presence and implementation of the LEI code of financial bodies. In the United States, certain legal acts such as

The Dodd-Frank Act, The federal reserve, and the SEC have jotted down the issuance of the LEI Code as an obligatory option for filing duties and its utilization in different monetary forms.

Based on the factual information and research results, LEI code is an essential element for entities’ global identification and validation for its pragmatic offerings and synergized course of action.

Follow – https://sggreek.com for More Updates