Table of Contents

What is E-Verification

It is no secret that; E-Verification of ITR needs to be done! But, what is E-Verification? E-Verification Of ITR (Income Tax Return) means electronic verification of the ITR, where the taxpayer verify his/her tax returns via generating EVC (Electronic Verification Code).

- E-Verification Of ITR

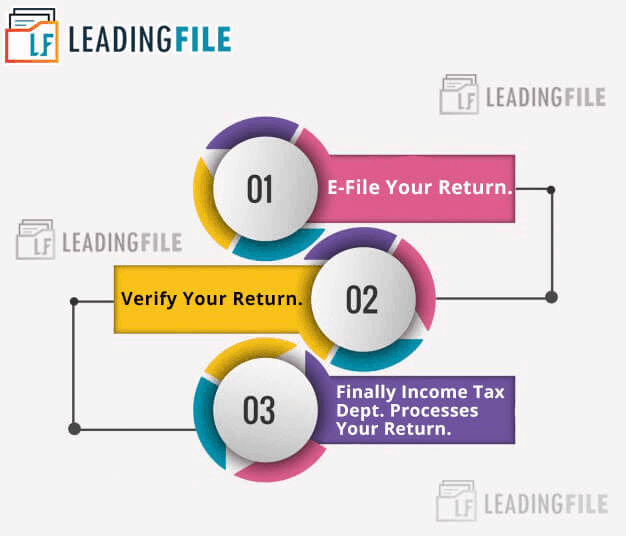

- To the known fact – the verification can only be done after filing your tax returns!

- In other words, after successfully filing your income tax return. the next step is to verify it!

- Once verified, the Income Tax Department starts processing your return. But, what it meant, to be done with the e-verifying of ITR?

- Obviously – successful e-filing of your income tax return! For that, follow the steps shown below:

Successful E-filing Of Your ITR

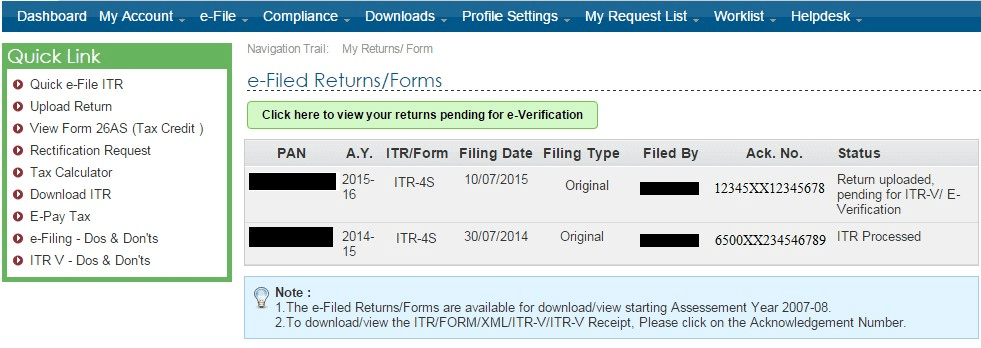

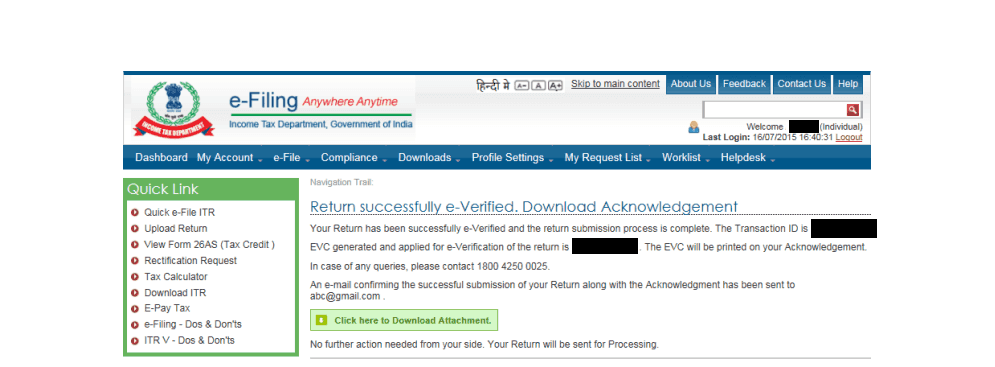

An image to illustrate the same is attached from the source – LeadingFile.

-

Successful E-filing Of Your ITR

- It was all about the successful e-filing of ITR.

- Now, concerning the step 02: i.e verify your returns, in detail.

- A detailed view of the same is as – Generally, there are two methods – one is offline and the other is online!

- To which we recommend opting the online, done throughout the net banking. But, if you don’t wish to e-verify your ITR, online then you need to go along with the offline process.

- A guide to offline/physical e-verification of ITR is below the text: Offline ITR E-Verification Process!

Easy Steps To E-Verify Income Tax Return

In order to e-verify your ITR (Income Tax Return), follow the steps illustrated below:

Here, in this article, we have discussed the e-verification done through net banking. As off – it’s the easiest and fastest method to e-verify ITR (Income Tax Return).

Later, if you wish to e-verify your ITR through any other method then pay a glimpse over the text elaborated as: E-Verify ITR.

6 Quick Methods To – Online ITR E-Verification:

Getting back to the stuff…

For e-verifying your ITR through net banking, please make sure that you have access to the net banking.

Somehow means that you can only verify your tax return, only if you have availed the net banking facility of the particular bank account.

Thereafter, follow out the steps illustrated as follows:

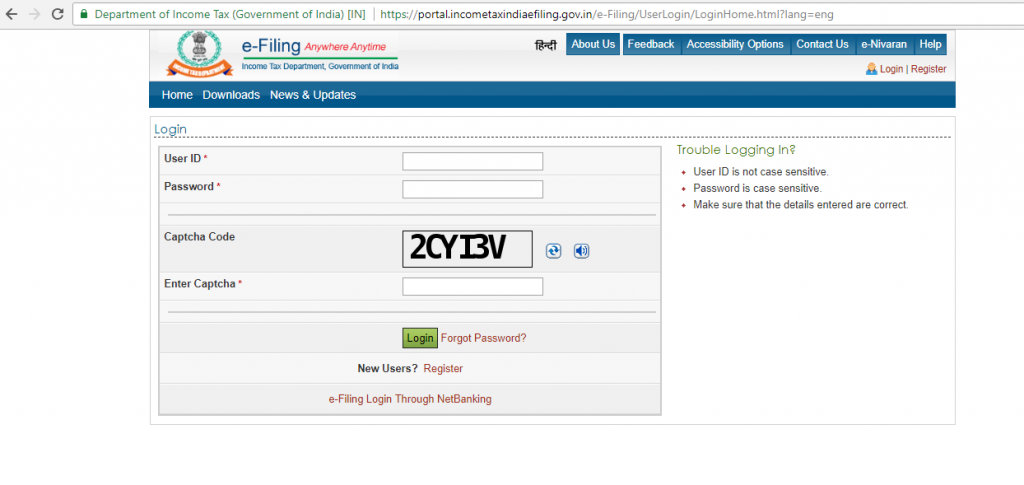

Step 01: Login to official website i.e, incometaxindiaefiling.gov.in, throughout the valid credentials.

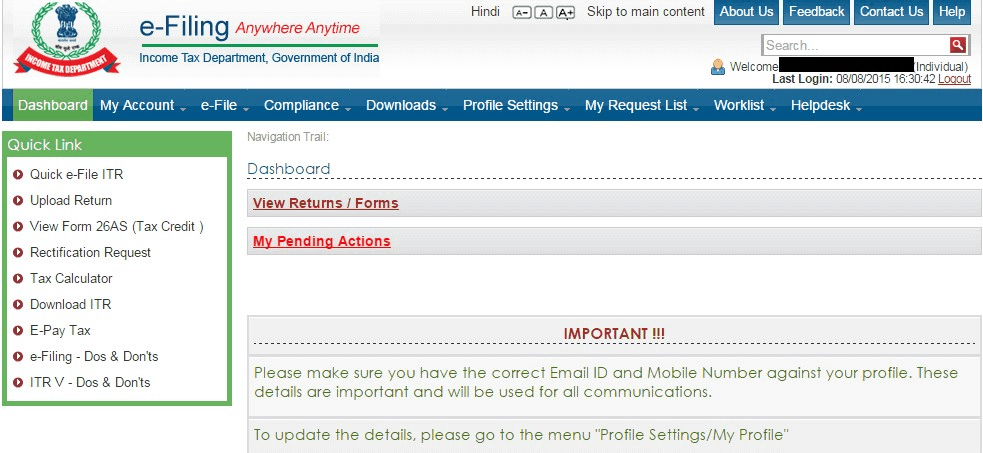

Step 02: To view e-filed tax returns, choose “View Return/Form” option.

Step 03: Go along with the option “Click here to view your returns pending for e-verification”, in order to view the pending returns.

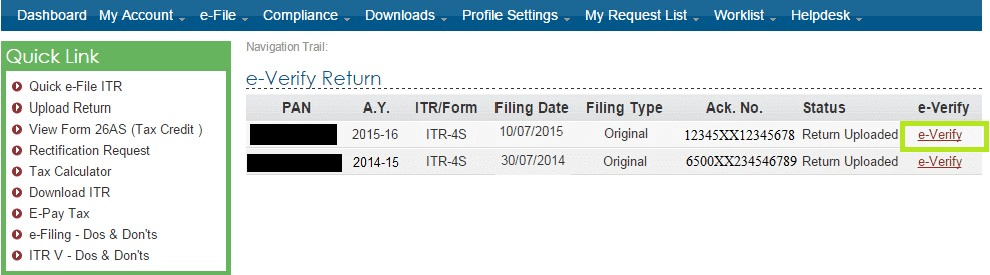

Step 04: Go along with the option ‘e-verify’, in order to verify your return.

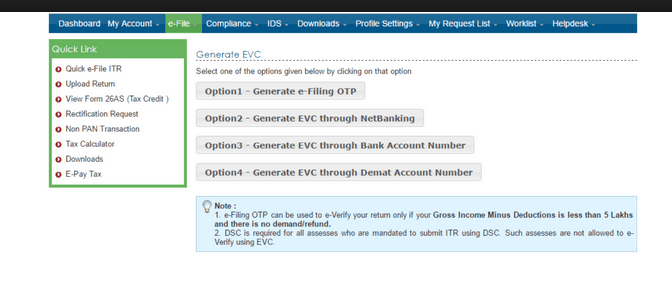

Step 05: Just after opting the “e-verify” option, you will be redirected to a list of modes through which you can generate an EVC (Electronic Verification Code).

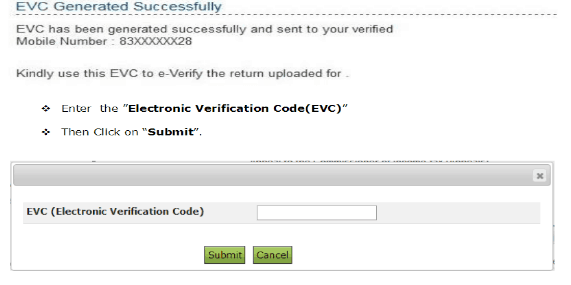

Step 06: Once you’re done with the EVC generation, enter the code which you have received over your registered mobile number & press over the “Submit” button.

Step 07: Later to this, you will receive a confirmation message along with a transaction ID and EVC.

Step 08: All done! In order to download the attachment, press over the green button displayed just below the confirmation message.

How to E-verify your Income Tax Return using Aadhaar Card

Aadhaar and enrolled all things considered in the Exceptional Recognizable proof Specialist of India (UIDAI) database. When this technique for confirmation is chosen, a SMS with the OTP is sent to your enrolled portable number. Enter the OTP got in the crate where it is required and click on submit.

Generating EVC via Net-banking

You can check your ITR in the event that you have benefited the Net financial office of your ledger. One must recall that just select banks enable you to e-check your ITR. Snap here to know, income tax return 2019, the rundown of banks. Likewise, before signing in to your financial balance, E-Verification Of ITR, guarantee that you are not as of now signed in on the e-recording site.

To check your ITR utilizing Net financial office, income tax refund, login to your ledger on the bank’s site. Select the e-confirm choice which is ordinarily under the ‘Duty’ tab. You will be diverted to the e-documenting site of the pay charge office.

Snap on the ‘My Record’ tab and select ‘Create EVC’ choice. A 10-digit alpha-numeric code will be sent to your email and versatile number. This code is legitimate for 72 hours. Presently, go to ‘e-confirm’ choice in ‘My Record’ tab to check your arrival.

ITR verification by banks

An Electronic Confirmation Code (EVC) is a 10 digit alphanumeric code which is sent to the enrolled versatile number of the duty filer while documenting his/her profits on the web. It checks the personality of the expense filers. Such assessment filers incorporate people just as Hindu Unified Family (HUF).

To check your ITR utilizing, know your pan, your financial balance, you should pre-approve it. Go to the profile settings in your e-documenting record to pre-approve your financial balance. Enter the required subtleties, for example, your bank’s name, account number, IFSC code, and versatile number.

To produce EVC, visit your bank’s ATM and swipe your ATM card. Snap on the ‘Stick for e-recording’. An EVC, E-Verification Of ITR, will be sent to your enrolled versatile number. This EVC is substantial for 72 hours. Sign in to your e-recording account on the salary charge site. Go to the ‘e-check returns’ choice. Select the ITR to confirm it and select the choice ‘As of now produced EVC through bank ATM.’ Enter the EVC, income tax form 16

and your expense form will be checked.

Conclusion

- Here, in this blog, we have discussed the E-Verification Of ITR: Easy Way To Verify Income Tax Return.

- Often we concluded its layout, successful e-filing of income tax return and at last the key easy steps to e-verify ITR (Income Tax Return) in detail.

- They add value to any blog post. And, this leads to the end of the blog.

- We hope this blog helped you. Fast forward, if you found the blog useful then don’t forget to use the comment section. Even, do share the blog with your peers.

- Well, you are on your way of getting more exposure!